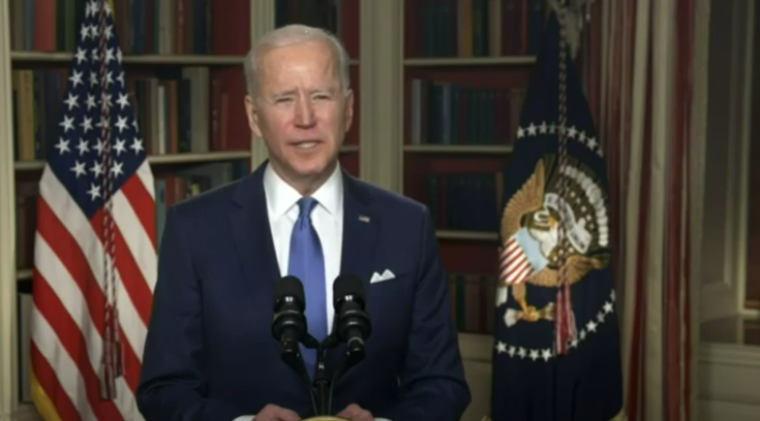

Not all Democrats have guzzled the modern monetary mania that the national debt, currently at $68,400 per citizen or $183,000 per taxpayer, doesn’t matter. To pacify them, President Biden proposes raising taxes to pay for some of his binge spending.

He wants to raise the top marginal income tax rate to 39.6% from 37% and nearly double taxes on capital gains to 39.6% for people earning more than $1 million. President Trump had reduced corporate tax rate from 35% to 21% and Biden wants to raise it to 28%. Finally, Biden wants to raise gasoline taxes, the most regressive of all taxes.

Corporations rarely pay for such tax increases because they pass the costs on to consumers as higher prices, but talk of sticking it to large corporations is beautiful music to the ears of socialist Democrats, who avoid learning economics at all costs. In the real world where the rest of us must live, individuals pay most taxes.

Biden’s tax increases will impoverish average Americans, but Democrats hope the spending binge will compensate. They will hurt the working poor the most because the government has created many tax shelters for the wealthy to hide their riches from Uncle Sam’s grasping claw. And they will hurt small businesses more than the large corporations that Americans love to hate, and thereby boost the power of cartels in every industry.

President Trump reduced corporate taxes because the U.S. rate was higher than the rates in other industrialized countries, and that made U.S. manufacturers unable to compete in many markets. Biden’s increase will shove more jobs overseas to avoid high tax rates in the U.S. Overall, higher corporate taxes will mean less investment in U.S. businesses, slower job growth, and lower wage increases. That’s introductory economics.

The economics of binge spending and tax increase is too complex for most Americans to grasp, since most never take an introductory economics class or read an economics book. So let’s look at the moral aspect of taxation as the Godly theologians of the University of Salamanca, Spain, did during the Reformation. Before they examined taxation, they had to determine the purpose of government. Today, people answer that by saying the government is supposed to do whatever is for the common good. But the Salamancan theologians didn’t see it that way.

Theologians see the beginning of human government in the Bible when God told Noah in Genesis 9:6, “Whoever sheds human blood, by man his blood shall be shed, for in the image of God He made mankind.” The next statement in the Bible on government comes when God created the nation of Israel and gave it no human king or legislature, leaving it only courts for government institutions. God performed the role of king by giving Israel its laws, 613, most of which dealt with temple ceremonies.

The courts decided only the civil laws, most of which dealt with property, indentured servitude, and violence. Given the absolute monarchies that existed at the time, the government of Israel was radically limited to just punishing evil doers. God was very angry with Israel for demanding a human king and warned them of the tyranny that human kings would inflict upon them. Read I Samuel 8. God allowed a human king as punishment for Israel’s rebellion.

In the New Testament, the Apostle Paul told Roman Christians in chapter 13 that the role of government authorities is to punish evil doers: “They are God’s servants, agents of wrath to bring punishment on the wrongdoer…This is also why you pay taxes…” The authors of the U.S. Constitution created a federal government that they intended to be limited to punishing evil doers and national defense.

After discerning that the role of government is to punish evil doers who violate the rights to life, liberty and property of others, the theologians of Salamanca determined that the state has the authority to collect taxes for that purpose and for no other. If the state collected more than it needed for that limited role, it was committing theft and violating the commandment, “Thou shalt not steal.”

Most of what the federal government does with tax revenue is transfer money from the wealthy to the middle class and working poor, clearly not in the Biblical mandate of punishing evil doers or legal under the Constitution. What does infrastructure spending have to do with punishing evil doers?

Also, theologians for centuries have insisted that the government must treat all citizens the same since authorities are agents of God who treats all people the same. So, until the 20th century, most Americans considered “progressive” taxation, or taxing the rich more than others, to be immoral. Then socialism became popular and Americans forgot about morality.

By worshipping their idol social justice, or socialism, Americans have created a very unjust government in the way it taxes people. Biden’s spending binge is not only an economic disaster, it’s immoral as well because it violates the state’s requirement to treat citizens equally and it adds to the theft from citizens that the government has committed for over a century.

No comments:

Post a Comment